risks associated with closed end funds

A Closed End Fund CEF is an investment company which is listed on an exchange and traded intraday at prices determined by supply and demand in the market. Many mutual funds invest in junk bonds but when you add a discount.

Difference Between Open Ended Funds Vs Close Ended Funds

All bond closed-end funds are subject to some degree of market.

. An SEC-registered investment adviser and is associated Dow Wealth Management LLC. The risks associated with closed-end funds. As always it is important to consider the objectives risks charges and expenses of any fund before investing.

A closed-end fund is a portfolio of pooled assets that raises a fixed amount of capital through an initial public offering IPO and then lists shares for trade on a stock exchange. Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. Ad Learn why mutual funds may not be tailored to meet your retirement needs.

The single biggest risk in ETFs is market risk. Closed-end funds are build like a mutual fund but trade like a stock. Get Answers Now Today.

Closed-end funds CEFs can be one solution with yields averaging 673. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF. CEFs are an option for experienced investors who enjoy market details.

This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains. Closed-end funds provide exchange-traded flexibility income potential ability to tap into specialized asset classes and lower investment minimums. Ad The integrated alternative investment solution that powers the worlds top investors.

Combining equity credit expertise to offer innovative alternative investment solutions. A closed-end bond fund is a popular type of investment as it is a convenient and affordable way to increase income. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds.

Prices might fluctuate from a high to a low value point in a. Weve summarized everything you need to. Ad Choose From Hundreds Of No Transaction Fee Mutual Funds.

Closed-end funds raise a certain amount of money. In secondary markets closed end fund shares are frequently accompanied by considerable trading volatility. Like any investment product closed-end funds come with a range of risks which well cover next.

The two other main types of investment companies are open. Closed-end fund definition. A closed-end fund is one of three main types of investment companies that the Securities and Exchange Commission regulates.

This article originally appeared on Sarasota Herald. Closed-end funds CEFs can be popular vehicles for portfolio diversification in the long-term although these funds come with certain volatility risks. Now we will discuss risks associated with CEFs.

So if you buy an SP. CEFs are primarily designed. One definite advantage that closed-end funds offer is access to specialized assets such as junk bonds or bank loans.

Get this must-read guide if you are considering investing in mutual funds. Ad The integrated alternative investment solution that powers the worlds top investors. Shares of closed end funds in secondary markets are often accompanied by high volatility in trading.

Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment. CEF structure has been beneficial to take advantage of key market. At year-end 2021 assets in bond closed-end funds were 186 billion or 60 percent of closed-end fund assets.

Like a traditional open-end mutual. We researched it for you. A closed-end fund or CEF is an investment company that is managed by an investment firm.

Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below. Prices may swing from one high value to a low value point all in one days trading. As investor interest in closed-end funds.

Pros and Cons of Closed-End Funds. What are the risks associated with Closed-end Funds. Answer 1 of 2.

Combining equity credit expertise to offer innovative alternative investment solutions. What are the risks associated with Closed-end Funds. Closed-end funds can offer advisers.

Ad Explore Closed End Mutual Funds. A closed-end fund CEF or sometimes called closed-ended fund is a pooled investment that issues a fixed number of shares. Open An Account Today.

One type is Closed-end Funds. Risk in closed-end funds. Find Out What You Need To Know - See for Yourself Now.

What Are Closed End Funds Fidelity

What Are Closed End Funds Fidelity

Difference Between Open Ended And Closed Ended Mutual Funds

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Varan S Instablog Finance Organization Investing Blog Posts

Rr Investors Offers Nfo Uti Capital Protection Oriented Scheme Series Iv I 1103 Days Http Goo Gl Bnxohr Mutuals Funds Investing Fund

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

Investing In Closed End Funds Nuveen

Investing In Closed End Funds Nuveen

Investing In Closed End Funds Nuveen

Investing In Closed End Funds Nuveen

Difference Between Open Ended And Closed Ended Mutual Funds

Difference Between Open Ended Funds Vs Close Ended Funds

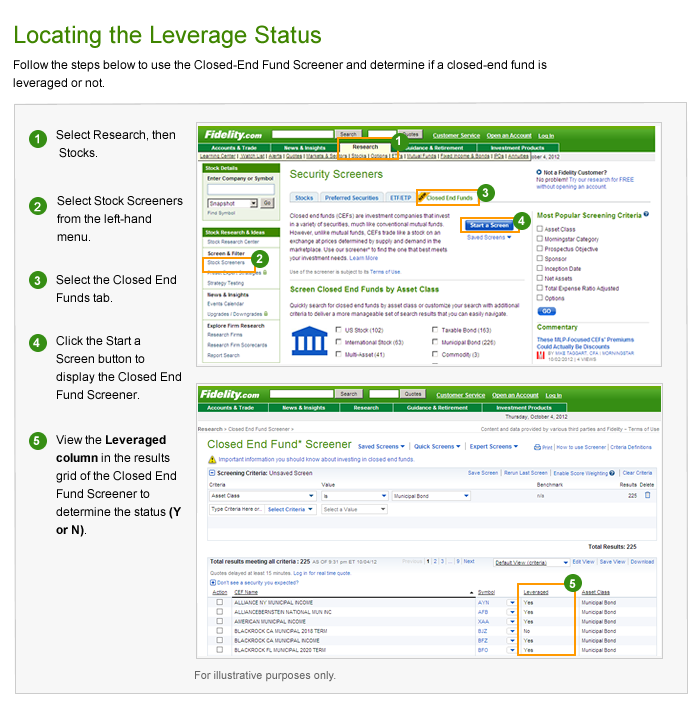

Closed End Fund Leverage Fidelity

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2e2c46e0fb00260ba168.jpg)

Trading Mutual Funds For Beginners

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Understanding Closed End Vs Open End Funds What S The Difference

Systematic Investment Plan Sip Is An Investment Program That Allows You To Contribute A Fixed Amount As Low Systematic Investment Plan Mutuals Funds Investing

/155571944-5bfc2b9646e0fb005144dd3f.jpg)